Climate change poses a significant threat to developing economies, which are disproportionately vulnerable to its impacts. To help these nations progress in their economic growth path and to mitigate the risks due to climate change, they need substantial and sustained access to climate finance. According to the IPCC (2023), developing economies would need $500 billion a year in climate finance by 2030, five times more than they have now.

This blog examines the crucial role that developing nations will play in the world’s transition to net-zero emissions, the climate financing gap, innovative funding options, importance of legislation, participation by the private sector, and collaboration across borders.

The Impact on Developing Countries

A large portion of developing economies’ income comes from industries like tourism, fishing, and agriculture that are susceptible to climate change. Climate-related disasters have the potential to significantly affect GDP, as demonstrated at various occasions where natural disasters have resulted in notable economic losses. The World Bank estimates that by 2050, climate-related disasters in South Asia might force up to 143 million people to relocate. Given that they have fewer financial and technological resources, developing nations are less equipped to adapt to climate change and are therefore more vulnerable. Poverty, urbanisation, and rapid population expansion all worsen vulnerabilities. There is a huge funding vacuum in developing economies for climate action. The current financial flows are insufficient to meet the targets set forth in the Paris Agreement, and considerable expenditures are required for both mitigation and adaptation measures.

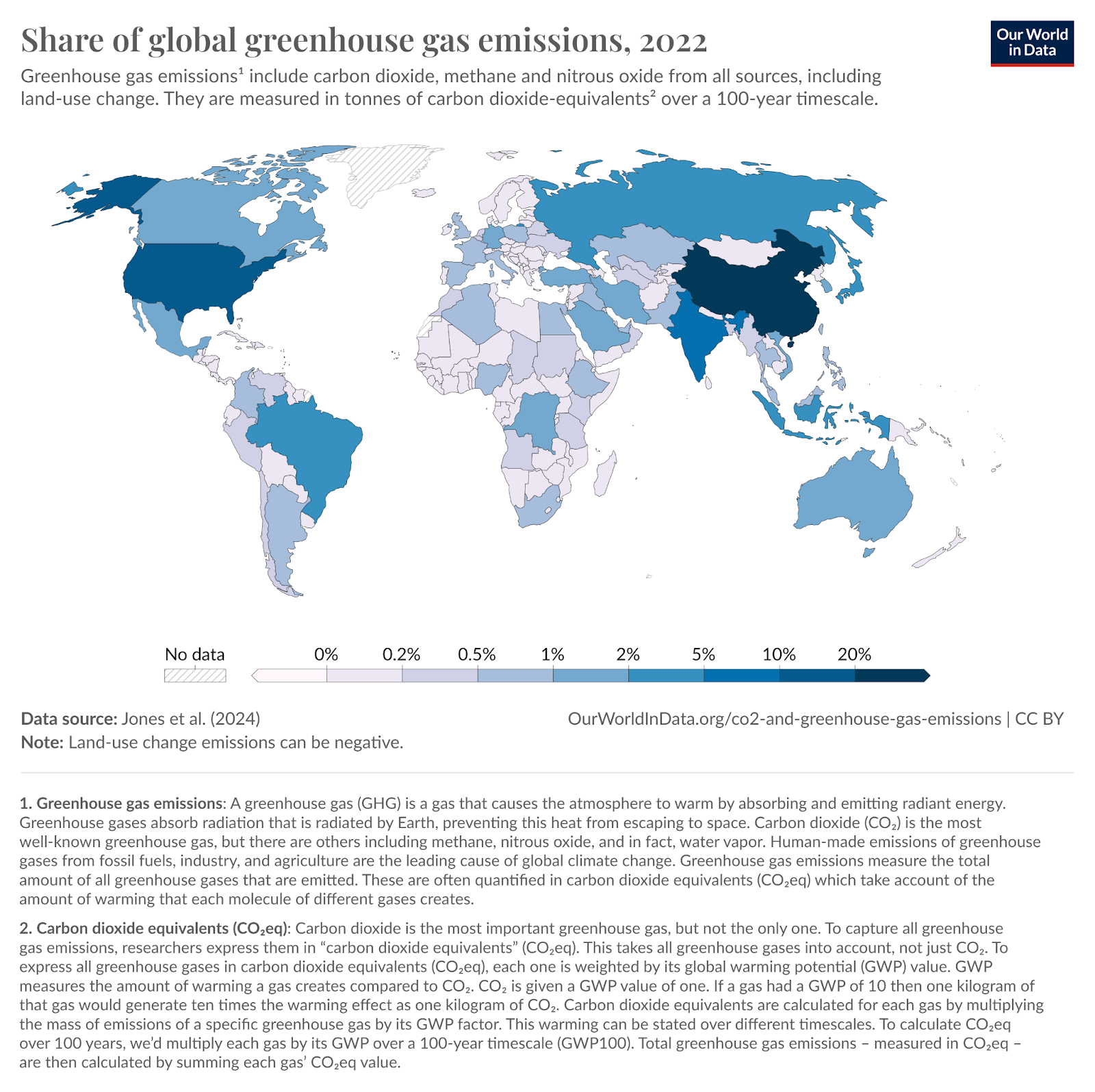

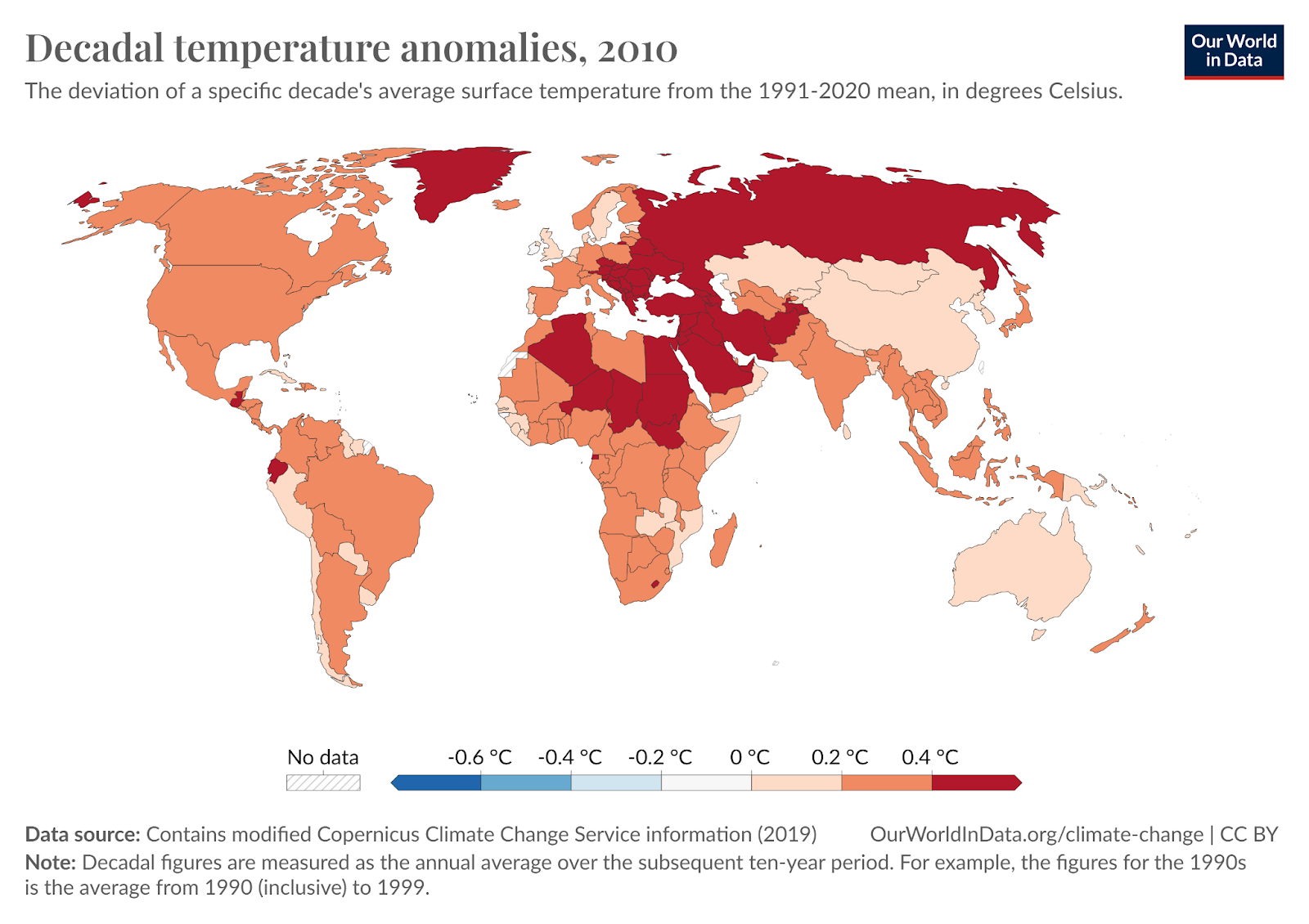

If we compare the two maps, we can clearly see that despite having less historical responsibility for greenhouse gas emissions, developing countries are experiencing significant temperature anomalies. These temperature increases are often higher than the global average, exacerbating the frequency and intensity of heatwaves, droughts, and other extreme weather events. Climate solutions need to be holistic as increased emission in one part of the world can cause severe consequences in other countries that might reach their net-zero targets much earlier.

Developing Countries Have a Critical Role to Play in the Global Transition to Net Zero

While the historical emissions are low in developing countries, their current and future emissions are significant due to rapid industrialization and urbanisation as well as from shifting of major manufacturing activities from global north to global south. A move towards transition to renewable energy(RE) and low-carbon technologies is essential for these countries to contribute to global net-zero goals. Investing in these can drive economic growth, create jobs, and improve energy security. Countries like India and many other developing nations are already seeing benefits from solar and wind energy projects while others follow suit. As per McKinsey’s study, Africa has the potential to generate ~800000 new jobs in high-potential new green business areas and ~35 billion dollars of export revenue from green hydrogen, transition commodities and carbon credits. Developing countries can learn from past precedents of industrialization and leapfrog to advanced technologies, bypassing more polluting phases of development.

Bridging the Climate Finance Gap in Developing Countries

Developing countries need trillions of dollars annually for climate adaptation and mitigation efforts and there is a significant disparity between current funding levels and the amounts needed. For Example, under a net-zero 2070 pathway, India would need a total investment of USD 10.1 trillion and the investment gap would be USD 3.5 trillion if we depend only on the conventional sources. There are three major categories through which developing countries raise capital First is domestic funding through public or private sources. For example, taxes or the reduction of subsidies and private sources could be investments from domestic institutional investors and banks. Second is external support-based financing such as grants, concessional loans, or equity from bilateral, multilateral, and philanthropic organisations. The third source is private, commercial investments in climate related activities at market rate with the purpose of making profit. There are various challenges involved in all three but majority of these fall under two categories 1) Complexity and stringent norms 2) Low sovereign rating and high risk perceptions. But we have seen hope in recent times with increased participation of the private sector especially in the RE sector and Climate Bonds Initiative(2022) projects green bond issuance in emerging markets is expected to grow by 20% annually.

“The current climate finance landscape is woefully inadequate for developing economies. We need to see a significant scale-up in finance, particularly for adaptation and resilience-building measures,” says Dr. Jane Kabubo-Mariara, Director of the African Development Bank’s Climate Change and Green Growth Department.

What Should Be the Focus for Climate Finance in the Global South?

There is lot to be done and role of each player from the marco to micro player is critical to ensure that we reduce the climate finance gap as much as possible, few of the suggested solutions are:

- Blended Finance: Combining public and private funds to reduce investment risks and attract private sector participation. Example: The Green Climate Fund’s use of blended finance to support renewable energy projects.

- Green Bonds: Issuing and promoting bonds specifically for funding environmentally sustainable projects though green,social,sustainability and sustainability linked bonds(GSSS bonds) will build investor confidence and mobilize necessary resources.

- Insuring the Vulnerable: Providing financial protection against climate-related losses. Innovations in climate insurance with data driven underwriting and risk assessment can help the most vulnerable to manage risks.

- Investment in Technology: Adaptation helps communities cope when disasters strike, recover quickly, and avoid long-term consequences. Early warning systems can save lives and deliver benefits that exceed their cost by factors of at least 4 to 10.

- Carbon Markets: Building robust carbon markets with internationally tradable credits are one form through which voluntary cooperation can be enabled.

- National-Level Frameworks and Policies: Strong national policies are essential to attract climate finance and ensure effective use of funds. Policies promoting renewable energy, energy efficiency, electric vehicles and sustainable land use are critical while transfer of technology to the developing countries in the hard to abate industrial sector is crucial from a long term perspective.

- Increased Private Sector Participation: The private sector plays a crucial role in providing the necessary capital for large-scale climate projects which can also be the catalysts for economic growth.

- International Finance Mobilisation: Global collaboration is vital to meet climate finance needs, with developed and industrialised countries ensuring that the developing world is taken along in the global net-zero transition through necessary support and guidance . International agreements such as the Paris Agreement, provide a foundation for coordinated action. Through annual summits such as the G20 or COP, global leaders must renew the commitments with more on ground action. These gatherings also provide platforms for brainstorming innovative ideas in bridging the gap in climate finance.

Immediate Action for Long-Term Gains

The opportunity to stabilise the global climate and limit temperature increases is rapidly diminishing, making immediate action crucial for both vulnerable developing countries and the world at large. Fortunately, climate action and economic development can go hand in hand. The substantial investments needed for climate initiatives can also generate new revenue streams and open up export markets for developing economies. Without decisive action, however, these regions could face increased emissions and environmental degradation as their populations and the impacts of climate change grow in the coming decades. We can achieve sustainable and climate-resilient development by focusing on collaborative efforts, leveraging innovative financing mechanisms, and implementing inclusive policies that incentivize decarbonization.