The Economic Survey is often viewed as a precursor to the Union Budget. The survey objectives include providing a critical evaluation of economic conditions, an assessment of the impact of public policies, and the effectiveness of the budgetary allocations by the Government of India. The budget, therefore, is expected to consider the survey observations in prioritising budget allocations for the next fiscal year while setting and signalling future policy directions. On this note, this blog searches for the economic reasoning proposed by the survey that influenced some key budget announcements. A closer look at key themes reveals whether the road from the Economic Survey to the Budget has been well-travelled this year.

Snippet 1. Some key messages from the Economic Survey and the policy response from the Union Budget this year.

| Issues raised in the Economic Survey | Response in the Budget FY’26 |

Theme 1. Regulatory landscape: The survey emphasised the following:

| Policy response:

|

Theme 2. Sustaining the infrastructure push through development finance institutions (DFIs):

| Policy response:

|

Theme 3. Energy security and transition: The survey highlights:

2. Nuclear energy as a potential alternative to fossil fuels provided the expansion in the usage addresses the concerns about safety | Policy response:

|

Source: Authors’ assessment from Economic Survey 2024-25 and Union Budget 2025–26.

Most of the concerns raised in the survey thus are forward-looking and aim to secure India’s energy security through a smoothened energy transition while boosting infrastructure and reducing firms’ regulatory compliance burden. While the budget responses are positive steps, much of the progress will rely on effective implementation.

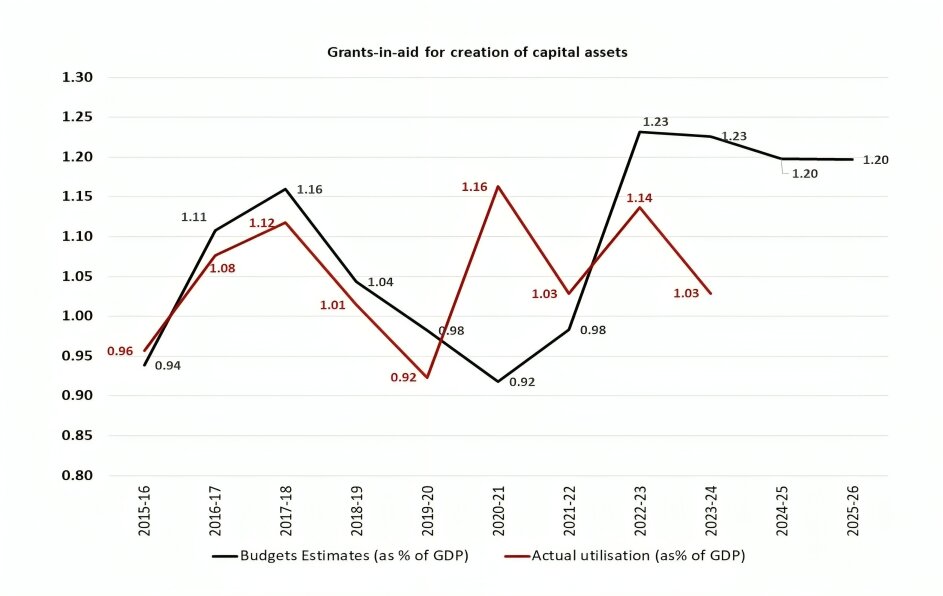

The capex push for infrastructure investments

As highlighted earlier, despite an increase in the levels of capital expenditure, the downward revisions of capex targets, and the lack of frontloading capex in the first half of the fiscal year do not bode well for the government’s plan for infrastructure push. The Economic Survey attributes the enforcement of the Model Code of Conduct in FY24 before the general elections and the heavy monsoons as the factors affecting capex in Q1FY25. Interestingly, close to 63.3% in FY20 and 56.3% in FY15 (both general election years) of the total capex targets were spent by the end of November compared to only 46.2% in FY24. The cyclicality of the budgetary allocations, and the actual utilisation under grants-in-aid for the creation of capital assets, is equally worrisome. (Figure 1).

Source: Author’s estimates based on data from Union Budgets

Furthermore, the additional borrowing limit for power sector reforms underscores policy continuity but also highlights the ongoing financial challenges in state DISCOMs, that will need to be addressed to realise the energy transition and ensure energy security. Meanwhile, with 90% of asset monetisation targets achieved between FY22–24, the budget’s INR 10 trillion plan for FY25–30 builds on past progress.

Addressing climate and sustainability challenges, especially for MSMEs

The survey rightly highlighted the challenges posed by non-tariff measures (NTMs) such as the Carbon Border Adjustment Mechanism (CBAM) on India’s export competitiveness. Setting up the Export Promotion Mission, with the involvement of the Ministry of Micro, Small, and Medium Enterprises (MSMEs), therefore, is a step in the right direction to cushion MSMEs against a rise in NTMs from the Global North.

Nevertheless, additional measures are needed to align India with global developments. One such measure is the introduction of a climate finance taxonomy. The EU taxonomy which has introduced multiple legislative frameworks since 2020, is now in the process of introducing a new package this year after facing severe backlash for the stringent requirements on sustainability reporting for SMEs. The ASEAN taxonomy for sustainable finance has been updated three times between 2021-2024. In India, on the contrary, the Task Force on Sustainable Finance (established in 2021) has yet to release its recommendations. Rolling out the climate finance taxonomy announced in the last budget sooner, therefore, will be essential for policy credibility. More importantly, the taxonomy should be a phased and multidimensional approach focusing on the social and governance dimensions with special attention to SMEs.

To summarise, there is evidence of synergies between the two important policy documents, particularly regarding energy security, infrastructure, and regulatory reforms. Achieving the intended outcomes will depend on robust implementation, ensuring policy continuity in critical sectors, and addressing unfinished agendas – such as the climate finance taxonomy, regulatory simplifications, and infrastructure capex.

By Honey Karun, Economist, Climate & Sustainability Initiative (CSI). Views expressed are personal.